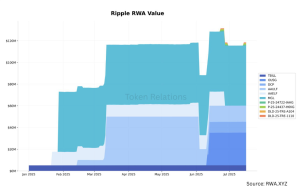

- Tokenized real-world assets on the XRP Ledger have grown from $5 million in January to over $118 million.

- XRPL’s DeFi ecosystem and stablecoin usage are expanding, with daily transactions averaging 1.77 million.

- Ripple’s global partnerships in the UAE, Europe, Asia, and South America are driving institutional adoption of XRPL.

The XRP Ledger (XRPL) is seeing a major increase in institutional activity. Tokenized real-world assets (RWAs) on XRPL have surged 2,260% since January 2025, growing from $5 million to over $118 million. This sharp rise, confirmed in a report by Ripple and Token Relations, highlights the growing interest in tokenizing U.S. Treasuries, real estate, and other assets on the network.

The XRPL is also expanding its decentralized finance (DeFi) offerings. The total value locked (TVL) in XRPL DeFi protocols has climbed by 57% in the past six months, now at $86.66 million. Increased adoption of stablecoins and decentralized exchanges (DEXs) has pushed daily transaction volumes to 1.77 million, supported by median transaction fees as low as $0.000037.

Stablecoin and DeFi Growth Strengthen XRPL’s Utility

Stablecoins are playing a central role in XRPL’s evolving ecosystem. RLUSD now has a market capitalization of over $65 million and operates alongside Circle’s USDC on the network. These assets are being used for payments and DeFi transactions, making XRPL an increasingly competitive player in digital asset infrastructure.

XRPL supports over 900 global nodes, including more than 170 active validators. Ripple controls less than 1% of validator nodes, keeping the network decentralized while maintaining high availability and speed. The network meets enterprise-grade demands with a throughput capacity of over 1,000 transactions per second and ultra-low fees.

Global Partnerships Accelerate XRPL Adoption

Ripple’s international expansion is reinforcing XRPL’s institutional relevance. In the UAE, the company has secured a license from the Dubai Financial Services Authority (DFSA), unlocking access to a $400 billion trade market. It has partnered with local fintechs like Zand Bank and Mamo Pay to power efficient cross-border payments.

Real estate tokenization is also advancing, with Ripple working alongside Ctrl Alt in Dubai to digitize property title deeds. Ripple has established custody service partnerships in Europe with DZ Bank, BBVA Switzerland, and DekaBank. Societe Generale has also integrated its stablecoin into the XRPL ecosystem.

In Asia, Ripple is collaborating with Straits in Singapore and BDACS in Korea. Meanwhile, Mercado Bitcoin has announced a $200 million tokenization initiative in South America. The launch of the BBRL stablecoin adds further momentum.

With over 3.3 billion transactions processed since launch, XRPL is evolving beyond payments. Its low fees, scalability, and growing institutional use cases place it at the center of the expanding tokenized asset economy.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.