- Trump says Fed Chair Powell is probably delaying rate cuts for political reasons, but does not plan to fire him.

- Powell is under pressure over renovation costs and may resign, which could lead to earlier rate cuts.

- Goldman Sachs expects three rate cuts this year as hiring slows and consumer spending weakens.

U.S. President Donald Trump has accused Federal Reserve Chair Jerome Powell of possibly delaying interest rate cuts for political reasons. During a press event alongside the Philippine president, Trump criticized Powell for keeping rates high and claimed that the U.S. economy needs cuts immediately.

Trump said interest rates should be at 1% as the economy is “hot,” suggesting that the Federal Open Market Committee (FOMC) is holding back for reasons beyond economics. However, the president added he does not plan to fire Powell, whose term ends in May 2026, noting that he “will be out soon anyway.”

The president also discussed the ongoing controversy around the Federal Reserve’s renovation expenses. Powell is under scrutiny after Rep. Anna Paulina Luna, a Trump ally, referred him to the Department of Justice for alleged perjury related to those renovation costs.

These events have sparked speculation that Powell may resign before his term concludes. If that occurs, markets could see an accelerated timeline for interest rate cuts.

Market Awaits Clarity as Labor Market Weakens

Trump’s remarks come just hours after Powell avoided any monetary policy discussion during a public speech. The silence has increased market uncertainty amid growing calls for easing.

According to Goldman Sachs, the Fed will likely cut rates at the remaining three FOMC meetings in 2025, starting after the July 30 meeting, where rates are expected to stay unchanged. The bank cited a weakening labor market and slowing consumer spending as key drivers behind the prediction.

Goldman Sachs noted that private-sector hiring has slowed to near “stall speed.” Additionally, consumer spending has declined for six consecutive months, a trend often linked to recessionary periods.

Job Postings Fall Sharply, Fueling Recession Fears

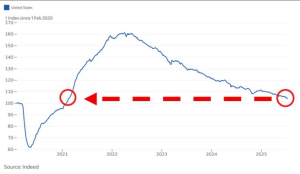

Market insights from The Kobeissi Letter support the case for near-term cuts. The platform reported that job postings on Indeed dropped 8% year-over-year as of July 11, reaching their lowest point since February 2021. The data shows a 65% decline from the March 2022 peak, with job openings only 4% higher than pre-pandemic levels.

These figures underscore mounting concerns that the U.S. economy is losing momentum. As uncertainty builds around Powell’s future and the Fed’s next steps, traders and crypto markets are watching closely.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.