Introduction

For decades, financial systems have relied on intermediaries. Banks, brokers, and payment processors manage transactions, loans, and savings. These institutions hold user data and charge fees for access. Regulatory agencies like the SEC or central banks also bind them. This model creates dependency, delays, and high transaction costs.

What Is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) is a financial system without banks or centralized institutions. It allows users to perform financial transactions directly with each other using blockchain technology.

A New Model vs Traditional Finance

Traditional finance depends on middlemen, such as banks, lenders, and brokers. These institutions control access, charge fees, and manage user data. DeFi replaces them with open-source code and decentralized protocols. In DeFi, transactions happen peer-to-peer.

Benefits of Removing Intermediaries

Without middlemen, DeFi offers faster transactions and lower costs. It improves access for people excluded by the traditional system. It also reduces reliance on governments or institutions that may restrict access or freeze assets.

Core Technologies Behind DeFi

DeFi runs on public blockchains like Ethereum. It uses smart contracts and self-executing code to enforce agreements. Users interact with DeFi through digital wallets, which store cryptocurrency and provide access to decentralized apps (dApps).

How Does DeFi Work?

Peer-to-Peer Financial Networks

DeFi runs on peer-to-peer (P2P) systems. These networks let users send and receive assets directly without banks or brokers. All participants interact on equal footing.

Smart Contracts on the Blockchain

DeFi uses smart contracts and self-executing programs stored on blockchains. These contracts define the rules of a transaction and enforce them automatically. They remove the need for human intervention or trust.

Wallets and Private Keys

Users access DeFi through digital wallets. Each wallet holds private keys, unique codes that prove ownership of funds. Transactions are signed with these keys and broadcast to the network.

Immutable and Transparent Ledgers

All activity is recorded on a public blockchain. Once a transaction is confirmed, it cannot be altered. Anyone can view the records, but personal identities remain private. This structure ensures both transparency and security.

Key Technologies Behind DeFi

1. Blockchain

Blockchain is the foundation of DeFi. It is a decentralized ledger made of blocks that record transactions. Each block is encrypted and linked to the previous one, forming a secure chain. No single authority controls the data, making it transparent and resistant to tampering.

2. Wallets

Wallets are digital tools that store cryptocurrencies. They allow users to send, receive, and manage digital assets. Wallets use private keys, which act like passwords, to give users full control over their funds.

3. Smart Contracts

Smart contracts are self-executing programs stored on the blockchain. They automate agreements between users. Once the terms are met, the contract carries out the transaction without needing a middleman.

4. Security Protocols

Security is critical in DeFi. Blockchains are immutable; they cannot be changed once data is added. All transactions are verified by network participants, ensuring trust without relying on central authorities.

DeFi Applications and Use Cases

1. Lending & Borrowing

DeFi allows users to lend their crypto and earn interest. Borrowers can access funds without credit checks. Yield farming rewards users for providing liquidity.

Example: Aave lets users lend and borrow assets through smart contracts.

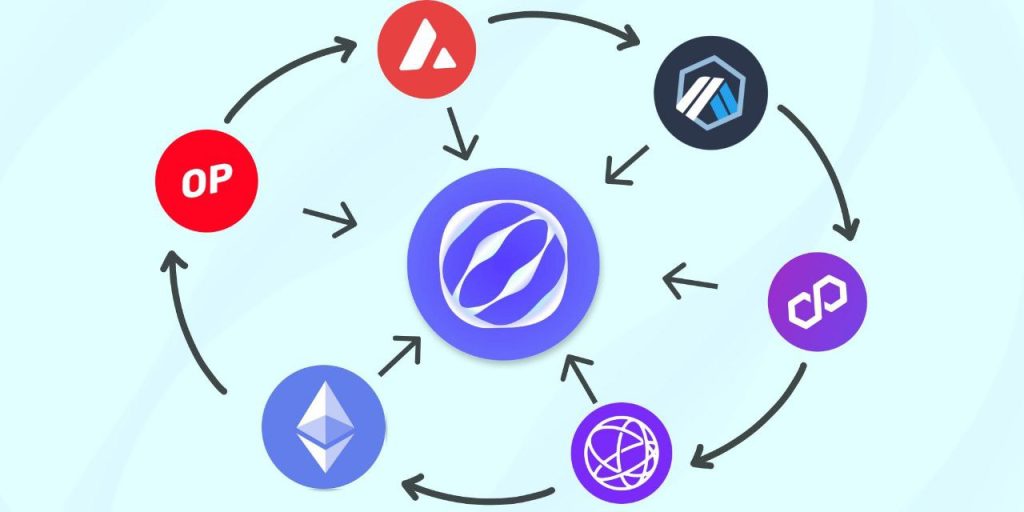

2. Decentralized Exchanges (DEXs)

DEXs enable users to trade cryptocurrencies directly. There’s no need for centralized intermediaries. Prices are set by smart contracts using liquidity pools.

Examples: Uniswap, PancakeSwap.

3. Liquidity Pools

Liquidity pools are funds locked in smart contracts. They help power trading and keep markets efficient. Users deposit assets to earn a share of trading fees.

4. NFTs and Asset Ownership

DeFi supports NFTs, which represent ownership of digital or real-world assets. These tokens are unique, traceable, and tradable. Users can buy, sell, or use NFTs as collateral.

5. Prediction Markets and Gaming

Users bet on outcomes in prediction markets. These platforms run on smart contracts. Some DeFi apps offer blockchain-based games with real earnings.

Examples: Polymarket, Azuro.

6. Staking & Yield Farming

Staking involves locking crypto to support a blockchain network and earn rewards. Yield farming involves moving funds across platforms to maximize returns. Both provide passive income opportunities.

Getting Started With DeFi

1. Research the Right Activity

Start by identifying your goal. Do you want to lend, trade, stake, or provide liquidity? Each has different risks and returns. Learn the basics before committing funds.

2. Choose a Wallet

Pick a secure crypto wallet that supports DeFi. Options include MetaMask, Trust Wallet, and Coinbase Wallet. The wallet will store your assets and interact with DeFi apps.

3. Purchase Crypto

Buy cryptocurrency from a centralized exchange (CEX) like Binance or Coinbase. You can also use a decentralized exchange (DEX) if you already hold crypto.

4. Connect Wallet to a DeFi App

Visit the official website of a DeFi platform like Aave or Uniswap. Connect your wallet securely through the interface. Ensure the platform is verified to avoid scams.

5. Monitor Performance and Risks

Track your funds regularly. Watch for price changes, smart contract bugs, or platform updates. Withdraw if the risks outweigh the rewards.

Goals and Benefits of DeFi

Accessibility for All

DeFi removes the need for banks. Anyone with internet access can use DeFi apps. There are no geographic or banking restrictions.

Lower Fees, Flexible Terms

Transactions in DeFi often cost less than traditional finance. Users can also negotiate lending rates and collateral terms directly.

Transparent Systems

All transactions are recorded on a public blockchain. Smart contracts automate rules. This allows users to verify everything themselves.

Personal Data Control

Users keep control of their wallets and funds, without sharing sensitive personal data with centralized services.

Financial Innovation

DeFi enables faster, open innovation. New tools like flash loans, staking pools, and synthetic assets are now possible.

Real-World Examples

Aave and Compound

Aave and Compound are popular DeFi platforms. They let users lend or borrow crypto. Interest rates adjust automatically. No banks or middlemen are involved.

Uniswap

Uniswap is a decentralized exchange (DEX). Users can trade tokens directly from their wallets. It uses liquidity pools instead of order books.

Use in Developing Economies

DeFi helps users in countries with unstable currencies. People can access stablecoins and save money. No need for traditional banks or credit systems.

P2P Lending

DeFi supports peer-to-peer loans. Lenders earn yield; borrowers get access to funds. Smart contracts enforce loan terms.

Global Remittances

Sending money across borders is faster and cheaper. Users avoid high fees from banks or remittance services. Funds arrive directly in wallets.

Risks and Concerns

Smart Contract Vulnerabilities

DeFi relies on smart contracts. If the code is flawed, hackers can exploit it. Millions have been lost to bugs and exploits.

Lack of Regulation

DeFi operates without formal oversight. No regulatory body guarantees consumer protection. Legal recourse is often unclear or unavailable.

Volatility and Hype Cycles

Crypto markets are unstable. Prices can rise quickly and crash just as fast. “Crypto winters” can last months or years.

Scams and Fraudulent Projects

Some DeFi apps are created to mislead users. They lure investors with promises, then disappear. Research is essential before committing funds.

Is DeFi Worth It?

Best for the Bold

DeFi suits tech-savvy users. Those who understand risk and are comfortable navigating crypto tools may find real opportunities.

Caution for the Conservative

If someone is saving for retirement or avoiding high risk, DeFi may not be ideal. Volatility and lack of regulation make it unpredictable.

Research Is Critical

Every DeFi platform works differently. Due diligence is essential. Users must verify the app, audit reports, and community trust before investing.

The Future of DeFi

Bridging Old and New

DeFi will likely integrate with traditional finance. Banks and fintech firms are exploring blockchain-based solutions.

Shifting Regulations

Laws are catching up. Clearer rules could bring stability and protect users without killing innovation.

Building for the Masses

Infrastructure is improving. Better user interfaces and faster networks will help onboard more people worldwide.

Institutions Are Interested

Big players are watching. Some are testing DeFi partnerships, seeing its potential to unlock new markets and cut costs.

Frequently Asked Questions (FAQ)

- What is DeFi in simple terms?

DeFi stands for decentralized finance. It allows people to send, borrow, and earn money using blockchain, without banks. - Is DeFi safe to use?

It can be, but risks exist. Hacks, scams, and bugs in smart contracts are real threats. Use trusted platforms only. - How do I start using DeFi?

You’ll need a crypto wallet, some tokens, and access to a DeFi app like Aave or Uniswap. Always research first. - Can I make money with DeFi?

Yes, through lending, staking, or yield farming. But profits are not guaranteed, and losses can be big. - Is DeFi legal?

It depends on your country. Regulations are still evolving, so always stay informed about local laws.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.