- Wintermute Trading submitted recommendations to the SEC for clearer tokenized securities rules and self-custody permissions.

- The firm wants DeFi integration for tokenized assets without requiring broker-dealer licenses and network tokens classified as non-securities.

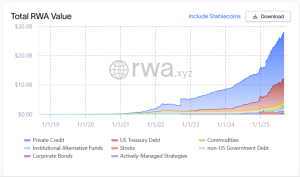

- The tokenized asset market has grown to $28 billion globally while major exchanges seek regulatory approval for tokenized securities trading.

Algorithmic crypto trading firm Wintermute Trading has submitted comprehensive comments to the U.S. Securities and Exchange Commission’s Crypto Task Force regarding tokenized securities regulation. The submission addresses critical regulatory gaps as major crypto exchanges pursue broker-dealer licenses to expand their tokenized offerings.

The market-making firm’s comments respond directly to the SEC’s ongoing efforts to establish clear regulatory frameworks for tokenized securities. Wintermute’s recommendations focus on three key areas essential for liquidity providers operating in the tokenized securities market.

Custody and Settlement Recommendations

Wintermute urged the SEC to provide explicit guidance allowing crypto brokers and dealers to trade tokenized securities from their accounts. The firm emphasized the importance of self-custody capabilities, including key management and wallet software solutions.

The trading firm specifically requested permission for on-chain settlement of tokenized securities. This includes settlements using stablecoins and other non-security digital assets. Such capabilities would streamline the trading process while maintaining regulatory compliance.

Current regulatory uncertainty around custody and settlement mechanisms has created operational challenges for institutional participants. Wintermute’s recommendations aim to address these gaps through clear regulatory guidance.

The firm advocated for expanded DeFi integration of tokenized securities. Wintermute recommended allowing tokenized securities in decentralized liquidity pools and direct lending protocols without requiring broker-dealer registration.

Wintermute argued these activities should not automatically trigger U.S. jurisdictional requirements. The firm believes such flexibility would enhance market liquidity while preserving decentralized finance benefits.

The submission also requested SEC clarification on major network tokens, including Bitcoin, Ethereum, Solana, and XRP. Despite their initial distribution methods or speculative trading activity, Wintermute argued these tokens should not be classified as securities under the Howey Test.

Growing Tokenized Asset Market

The real-world asset tokenization market has experienced significant growth under the current administration’s crypto-friendly policies. Global tokenized RWA market capitalization has reached approximately $28 billion, supported by over 191 million stablecoin holders worldwide.

Total Tokenized RWA On-Chain Value. Source: RWAxyz

Recent regulatory developments have accelerated institutional adoption. Dinari became the first platform to secure a broker-dealer license for tokenized securities trading. Major exchanges Kraken and Coinbase are pursuing similar regulatory approvals.

Galaxy Digital recently achieved a regulatory milestone by tokenizing its SEC-registered GLXY shares on the Solana blockchain. This development demonstrates growing institutional confidence in tokenized securities infrastructure.

Wintermute’s comprehensive feedback reflects broader industry momentum toward regulated tokenized securities markets. Clear regulatory frameworks could accelerate the adoption of tokenized stocks, ETFs, and other traditional financial products. The SEC’s response to these recommendations will likely influence the pace of tokenized securities integration into mainstream financial markets.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.