- Ripple’s aggressive expansion through the Hidden Road acquisition and blockchain upgrades positions XRP for institutional growth while CME futures show strong market demand.

- As multiple bullish catalysts align, technical indicators and chart patterns suggest XRP could break from its current range toward $5-$30 targets.

The XRP cryptocurrency has remained range-bound between $2.00 and $2.60 throughout recent months, but emerging developments suggest a potential breakout looms. Trading currently at $2.09, several converging factors could propel the coin into significantly higher territory.

Corporate Strategy Drives Ecosystem Growth

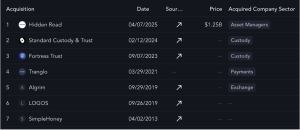

Ripple Labs has intensified efforts to expand its financial services footprint through high-profile corporate moves. The blockchain company’s acquisition of Hidden Road for $1.25 billion represents a calculated push into institutional prime brokerage services. This deal positions Ripple’s RLUSD stablecoin as core collateral within Hidden Road’s trading infrastructure.

The acquisition pipeline remains active according to company leadership. Ripple’s Chief Technology Officer, David Schwartz, revealed ongoing merger discussions at various completion phases. The company previously integrated Metaco and Standard Custody into its operations, building a comprehensive suite of institutional-grade services.

Beyond acquisitions, Ripple targets significant blockchain enhancements for its XRPL network. Planned upgrades include expanded programmability features and new lending mechanisms. The Wormhole collaboration aims to boost cross-chain connectivity across XRPL and its developing EVM Sidechain infrastructure.

These technical improvements could unlock new use cases for XRP across decentralized finance platforms and international payment networks. Enhanced functionality may attract developers and enterprises seeking robust blockchain solutions for financial applications.

Derivatives Market Shows Strong Appetite

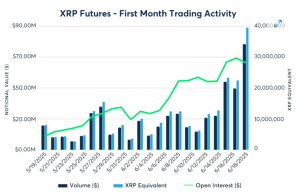

Since their May launch, future contracts with the Chicago Mercantile Exchange have generated substantial trading interest. XRP futures products accumulated over $542.8 million in aggregate trading volume, demonstrating significant market participation from institutional players and retail investors.

Launch day metrics exceeded industry expectations with $19.3 million in transactions across 15 institutional firms and four retail trading venues. The CME highlighted participation from exchange-traded fund providers alongside individual traders, indicating broad-based market interest.

International participation dominated early trading patterns. Nearly 50% of the 24,600 contracts traded during the initial month originated from non-US market participants. This global engagement suggests XRP’s growing recognition as a legitimate investment asset across international markets.

Spot ETF approval remains a potential catalyst for additional institutional capital allocation. Prediction markets currently assign 76% probability to XRP ETF approval before year-end. Historical precedent shows ETF launches typically correlate with increased mainstream adoption and price momentum.

Chart Patterns Signal Potential Upside Momentum

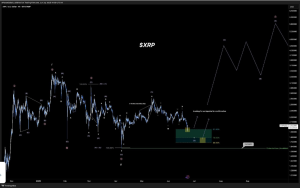

Multiple technical analysis frameworks point toward possible price acceleration for XRP. Recent price action shows a retest of critical Fibonacci support levels around $2.00, which analysts interpret as a foundation for renewed upward movement.

Wave pattern analysis suggests potential targets reaching $5 in the near term, while extended cycle projections indicate possible ranges between $20 and $30. Alternative chart methodologies using geometric patterns and extension calculations project similar upside scenarios spanning $8 to $27.

The current price structure resembles a consolidation pennant that could precede significant directional movement. Breakout measurements from this formation suggest potential gains exceeding 500%, translating to approximately $14 per token. Critical resistance sits at $2.65, marking the upper boundary of the existing trading channel.

Sustained moves above this resistance threshold likely open pathways toward $3 and beyond. Multiple analytical approaches converge on substantial upside scenarios, complementing fundamental developments within Ripple’s business ecosystem.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.