- XRP formed a golden cross pattern that historically led to 600% price gains, and analysts now target $6 based on bullish technical signals.

- BlackRock confirmed it has no plans to launch an XRP ETF, but other firms like Grayscale and Franklin Templeton still have pending applications.

- Whales bought over 50 million XRP tokens in 48 hours while the price trades around $3.20 despite the ETF setback.

XRP has formed a golden cross pattern on technical indicators, suggesting another significant price rally could be approaching. The current price of XRP in the United States is $3.20 per XRP / USD, showing resilience despite recent market volatility and regulatory uncertainty.

Technical Analysis Points to Bullish Momentum

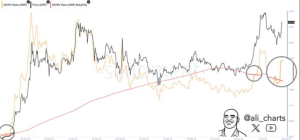

Market analyst Ali Charts identified a golden cross formation in XRP’s MVRV (Market Value to Realized Value) ratio. The shorter-term MVRV has crossed above the 200-day MVRV, historically a strong bullish signal for cryptocurrency. Previous occurrences of this pattern resulted in price surges exceeding 600%, providing a foundation for optimistic price projections.

XRP MVRV Ratio (Source: Ali Charts)

The golden cross appeared shortly after a death cross formation last week, raising concerns about potential downward pressure. However, the rapid reversal to a bullish crossover indicates strong underlying demand and buyer interest at current price levels.

Another technical analyst has spotted a falling wedge pattern on XRP’s three-day chart, which typically signals an impending bullish reversal. Historical performance shows XRP has successfully broken out from similar wedge formations, leading to substantial price gains. Based on this pattern analysis, the analyst projects XRP could reach $6 in the near term.

XRP Price Chart (Source: X)

BlackRock, the world’s largest asset manager, confirmed on August 8, 2025, that it has no immediate plans to file for a U.S. spot XRP ETF, even after the conclusion of the SEC vs. Ripple lawsuit. The statement came from ETF analyst Nate Geraci, who initially suggested BlackRock might pursue XRP and Solana ETF products following the resolution of Ripple’s legal challenges.

The firm’s spokesperson told The Block, “At this time, BlackRock has no plans to file an XRP or SOL ETF”. This clarification addressed widespread market speculation that emerged after the successful launches of Bitcoin and Ethereum ETFs.

As of August 2025, at least seven firms, including Grayscale, Franklin Templeton, and 21Shares, have a pending spot XRP ETF application. Despite BlackRock’s current stance, these alternative options maintain hope for institutional XRP products.

Whale Activity Continues Despite Setbacks

Large-scale investors remain active in XRP markets despite the disappointment of the ETF. Whale accumulation patterns show significant purchases exceeding 50 million XRP tokens within 48 hours. This institutional buying activity suggests confidence in XRP’s long-term prospects remains intact.

Combining technical bullish signals and continued whale accumulation creates a favorable environment for price appreciation. Nonetheless, robust support and ongoing consolidation above $3.00 highlight continued investor confidence in the XRP price, suggesting that further advances remain possible if favorable news emerges.

Traders closely monitor the $3.50 resistance level, with many analysts viewing a successful break above this threshold as confirmation of the next leg higher toward the $6 target. The golden cross formation provides technical justification for sustained upward momentum in the coming weeks.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.