- XRP hit $3.66 all-time high, and its market cap surpassed $200 billion after crypto bills passed the US House.

- Technical indicators show bullish momentum, and analysts predict XRP could reach $14 based on current chart patterns.

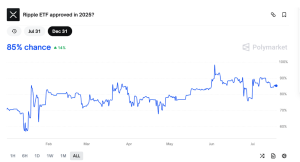

- Institutional demand is growing, and market speculation about a potential XRP ETF approval in 2025 remains high.

XRP reached a historic milestone on Friday, climbing to $3.66 as major cryptocurrency legislation advanced through the US House of Representatives. The rally pushed XRP’s market capitalization above $200 billion for the first time, marking a significant achievement for the digital asset.

The token’s price surge coincided with the passage of three key crypto bills in the House, including the GENIUS Act, establishing a federal framework for stablecoins. This development aligns with Ripple’s RLUSD stablecoin strategy and has strengthened investor confidence in XRP’s regulatory outlook.

Market Cap Breaks $200 Billion Barrier

XRP’s market capitalization jumped 12% in 24 hours and 63% over the past month, reaching a record high of $216 billion on Friday. Daily trading volume more than doubled to $22.5 billion, reflecting intense buying pressure from traders.

The derivatives market showed similar momentum, with trading volume exceeding $48.44 billion in 24 hours while open interest climbed to a new record of $10.98 billion. Short position liquidations totaled $73.17 million, significantly outpacing long liquidations of $29 million.

Institutional demand continues growing as companies like VivoPower and Webus announced plans to purchase $421 million worth of XRP for their corporate treasuries. Ripple’s recent application for a US banking license and Federal Reserve master account positions the company for deeper financial system integration.

Technical Analysis Points to Further Gains

The moving average convergence divergence (MACD) indicator produced a bullish crossover as XRP validated a bull pennant pattern on the weekly chart. The MACD measures relationships between two exponential moving averages and helps identify potential buy signals and trend reversals.

Analyst Mikybull Crypto noted the bullish MACD cross, stating the “real party is set to begin.” As seen in previous cycle tops, the weekly relative strength index (RSI) suggests XRP has room to advance before reaching overheated levels.

CryptoHado, a pseudonymous analyst, emphasized that XRP remains in “full price discovery mode” with the RSI far below 2018 peak levels. The bull pennant formation projects a potential 305% rally, targeting $14 per token.

Growing speculation around potential US spot XRP exchange-traded fund approvals has added momentum to the rally. Polymarket data showed 85% odds for SEC approval of a spot XRP ETF in 2025, following the success of Bitcoin and Ethereum ETFs.

The positive regulatory developments and Ripple’s ongoing SEC lawsuit resolution have created a bullish narrative driving XRP to new heights. Multiple analysts predict double-digit prices, citing institutional demand and favorable technical setups as key drivers for continued growth.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.